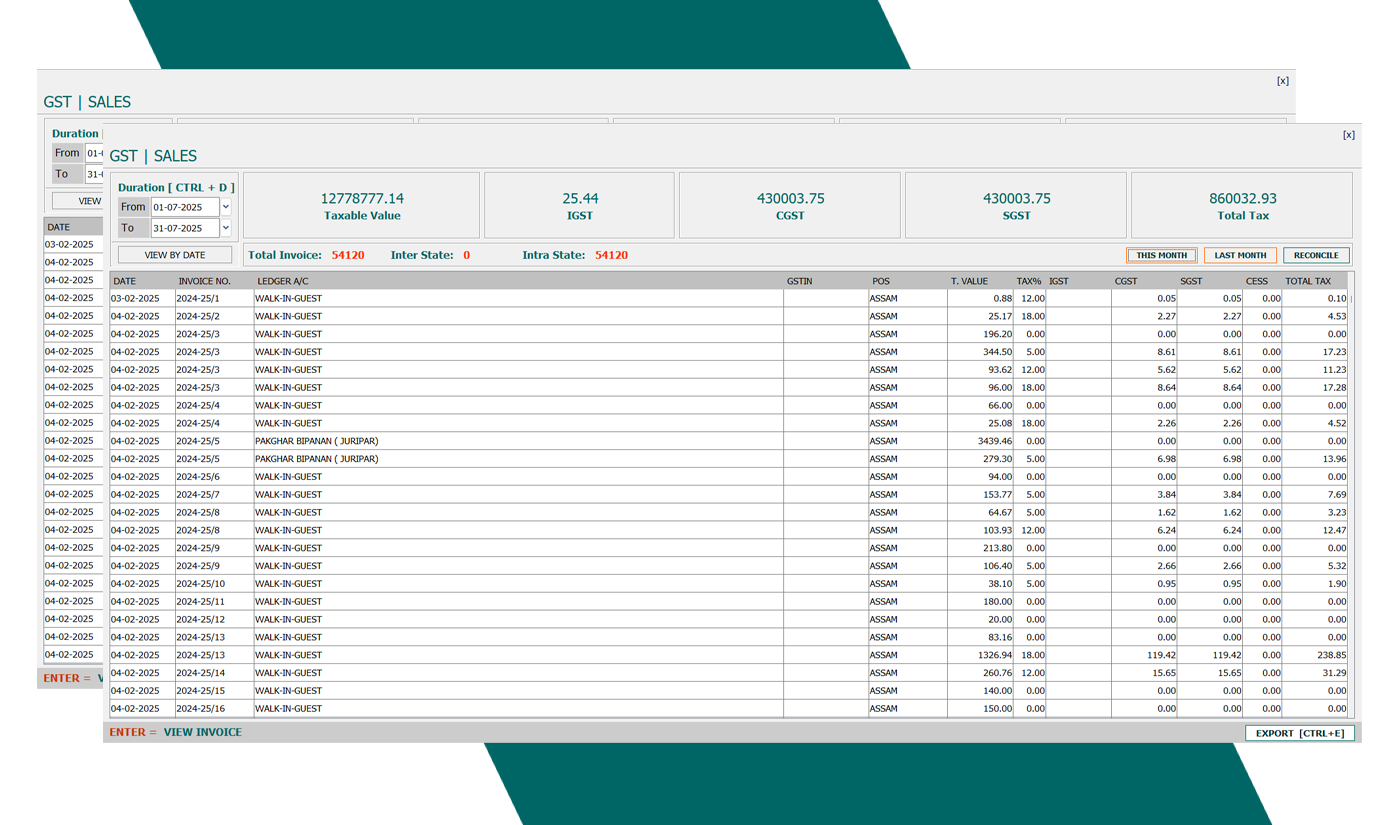

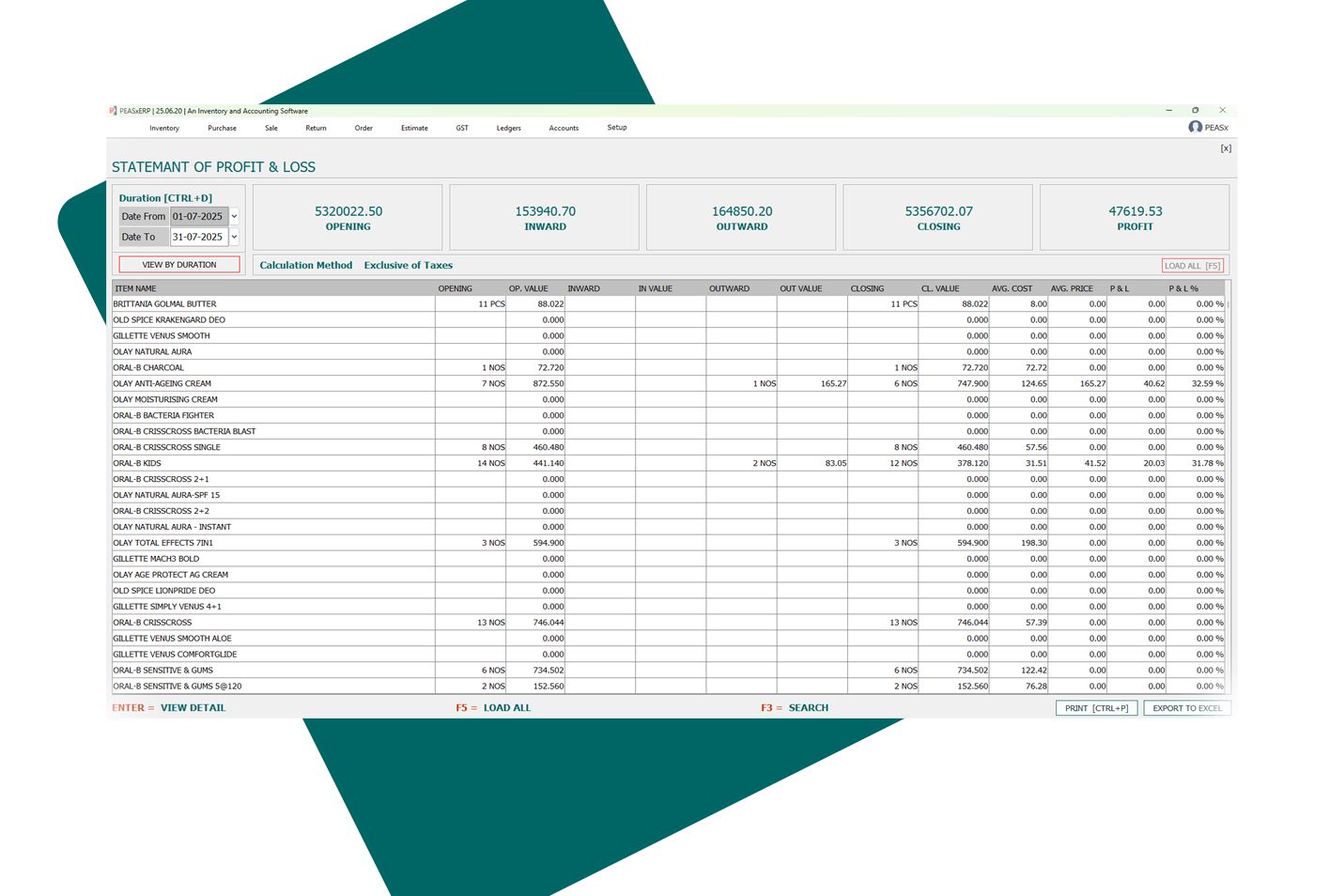

Comprehensive Reporting

Make informed decisions with built-in reports like Sales Summary, Ledger, Day Book, Trial Balance, Profit & Loss, and more. Export to Excel or PDF with one click.

👥

Customer & Vendor Management

Store contact details, payment terms, and transaction history. Know who owes what and build stronger relationships with timely reminders and CRM integration.

💰

Payment Tracking & Receipts

Record multiple payment modes like cash, bank, UPI, credit, and cheque. Send receipts instantly and maintain accurate account balances.

🔄

Returns, Credits & Adjustments

Handle sales returns, purchase returns, and credit/debit notes seamlessly. Your books stay clean and compliant without manual adjustments.